Hey! The Canadians are out in front. Not the one at the helm at the Bank of England doing his best to steady the good ship Sterling post the Brexit vote, but their Central Bank, which is working with R3Cev to put CAD on the Blockchain. Or to be precise to allow for CAD to be exchanged for CAD in Central Bank Digital Money (CBDM).

Wow. This is really serious and really good news. Let’s assume that the smart folks, of which there are plenty at R3Cev, can create something useful. What is in it for the financial services world?

I hope some auditors will read and comment. I am indebted to an old friend and mentor for challenging me up to now; thanks to the independent mind of Itzi Klein who is both very thoughtful and very thorough in sharing his wisdom.

The R word – Reconciliations

This is the daily diet and the bane of everyday life for people who work in the Operations functions of banks. The potential to eliminate a lot of this work has been widely associated with the Blockchain, for example in the December 2015 Working Paper from McKinsey: Beyond the Hype: Blockchains in Capital Markets.

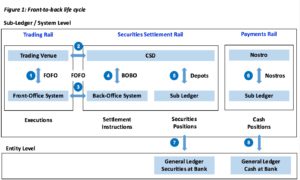

A lot of time and with that money goes into reconciling all the way along the lifecycle of a trade. To illustrate, let’s use the example of securities trading that results in a position in a Depot and a Nostro; see Figure 1.

Trades are executed at a trading venue and then passed to the CSD to be settled into a Depot. Any cash is sourced from a Nostro. The result is that there are eight points of reconciliation.

The model shown here assumes there are the same discrete silos in the cycle once things migrate to the Blockchain. In the jargon of the day, the Blockchain community uses the term “Rails”. Let’s also assume that the Canadians are successful with their CBDM, completing the set of “Rails” built on Blockchain principals.

What changes, what doesn’t?

A fundamental premise of the Blockchain proposal is that the current separation of a bank’s systems from the outside world is removed. I won’t repeat the detailed explanation here and would direct those who have not seen this assertion before or need to refresh their memories to the paper written by Richard Brown, the CTO at R3Cev.

Lessons Learned: My conclusion is that I think three good things happen:

- FOBO recs are not needed (1)

- BOBO recs are not needed (4)

- Depot & Nostro recs are not needed (5 & 6)

The best case is that the auditors are willing to accept the Blockchain proposition that there cannot be differences “inside the system”; there is no separation of statement and ledger.

Some things do not change:

The CSD has to reconcile to the Trading Venue (2), the FOBO rec between systems (4) is still required, as are the recs between Sub-Ledgers and the GL (7 & 8).

I hope you think the ideas are good; if you do, please “like” the post, share it widely and comment if you want to. If the ideas as wrong or just missing something, please share your thoughts by commenting.

Some readers will be familiar with the Swiss infrastructure: the Swiss Exchange, SIX Securities and SIC.

The sharper minds will:

- Say that the Swiss already have everything that the Blockchain might be bringing to the table. They are right, except that the Swiss infrastructure is side; it is CHF only and all that reconciliation has to happen today.

- Have a concern that an extra settlement location splits liquidity. They are right, but only in the first instance. As soon as there is more than one place to conclude a transaction, this is possible and banks suffer hugely with the associated issues today. However, if a central bank is willing to act as transfer agent and the transformation between fiat balances on an RTGS system and a Blockchain one is instant, then there things which a Blockchain platform can offer. The Swiss already have something very similar in SIX Repo; you can convert securities to cash almost instantaneously.

Previous Posts

Are available on the 3C Advisory website, click here.

Publications

The Bankers’ Plumber’s Handbook

How to do Operations in an Investment Bank, or not! Includes many of the Blog Posts, with the benefit of context and detailed explanations of the issues. True stories about where things go wrong in the world of banking. Available in hard copy only.

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that comes into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Thanks for your support.

Share on: