“Money is essential for Blockchain to do wonderful things”. I hope that those readers who have been following the posts agree with that. This week’s post will focus on three must do things or rules for moving money into a Blockchain platform.

#1 The Central Banks has to be the transfer agent for its currency

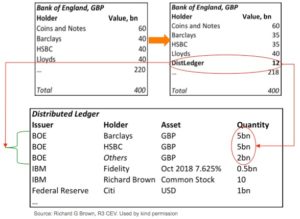

Working on the premise from prior posts that a transfer agent is needed to move between the old world”of payments systems and Blockchain and the one from last week’s post that the single best institution t o do this for a currency is the Central Bank, here is how this would work in accounting terms:

o do this for a currency is the Central Bank, here is how this would work in accounting terms:

Using the British Pound as an example, the Bank Of England (BoE) would be the transfer agent and keep track of requests to move money to or from the Blockchain platform. Any institution with an account at the BoE could ask for a transfer.

In theory too, an account holder at the BoE could transfer funds to a Third Party in the Blockchain. Imagine that Earthport, the global payments provider, held GBP 10 million with HSBC. It could ask HSBC to transfer that to a Blockchain platform. HSBC would do that via the BoE. Simples.

That makes two impositions on the BoE: first, it has a role to play as transfer agent and second it has a role to play on the Blockchain platform. This would be entirely within the BoE’s 1844 charter and its own mission statement:

“The Bank of England also fulfils several other financial stability roles: We regulate and oversee key payment, clearing and settlement systems…”

#2 One and Only One Payments Blockchain per Currency

“Bucket man” That was a nickname I gave to the cash manager at Nomura. His job was to have the right amount of cash in the right account at the right time. Each account is really a bucket and he wants the end of day contents to be zero. That is the aim for a “bucket man”, five days a week, but the more buckets he has to manage, the more the lyrics from the iconic song by Elton John are true: “… it’s gonna be a long, long time ..”, before you get to nirvana and all of them are flat.

So less is more and one per currency is quite enough. The Europeans will have to sort out the Euro and who does what; is the ECB the agent or each national Central Bank.

#3 All currencies need to be on the same single Blockchain platform

Today, every currency has at least one payments system. Some are not very efficient, some like the Swiss SIC system are incredibly efficient. That one payments system deals with “money”in all its forms: a retail client paying a medical bill or paying rent, payments to the credit card company, transfers between the banks and even provides the money to settle securities transactions from the CSD, the Central Securities Depository. Using some very differentiated pricing it ensures that retail, low value payments can use the same platform as multi-million Franc payments and securities trades.

So, I would make the case that one is the right answer for any one currency. Does it make sense then to have one for all currencies? To answer that question, there are two great examples of multi-currency processing that are worth examining: one for securities and one for payments.

Starting with payments, CLS Bank supports the lion’s share of FX settlement using a Payment vs. Payment mechanism; this allows the simultaneous exchange of an amount of one currency for an equivalent amount of another currency. CLS Bank deals with some USD 5 trillion in FX trades per day, and some 1.5 million FX trades. Without CLS Bank, the fallout from Lehman’s collapse would have been a meltdown and the fluid functioning of today’s FX settlement totally unimaginable. Simple conclusion: having a platform to settle some FX trades is a very good thing. Having a platform to settle any FX trades would be an even better thing.

In securities, the grand old lady of things multi-currency in the world of securities is Euroclear. Since 1968, it has enabled multi-currency settlement with volume today at something over USD 2 trillion per day. In contrast to CLS Bank, Euroclear does offer its members credit facilities; a debit in one currency is secured by the securities balances and any other long cash balances. Without Euroclear the international bond markets would really not function. Yes, there is Clearstream too, about which one could say the same. The point though is that this platform is an essential one.

Lessons Learned: There is no good reason that Central Banks should not be the body tasked with enabling money to connect to the Blockchain and there is every reason that they should do this in concert. They even have a body pre-destined to drive this: the Committee on Payments and Market Infrastructures (CPMI), formerly known as the CPSS.

Now what we need are some good reasons why they should bother about this. More on that in the next post.

Understanding Bitcoin and Blockchain

My own epiphany in matters Bitcoin and distributed ledger technology is the result of three independent sources: I am indebted to Emmanuel Mogenet at Google for his inspiring gift of a Bitcoin, to Richard Brown at R3 CEV for so readily sharing views and educating the latecomer and finally to Silicon Valley legend and LinkedIn CEO, Reid Hoffman for his seminal article in the May 2015 edition of Wired UK: “Reid Hoffman: Why the Blockchain matters.”

Previous Posts

Are available on the 3C Advisory website, click here.

Publications

The Bankers’ Plumber’s Handbook

How to do Operations in an Investment Bank, or not! Includes many of the Blog Posts, with the benefit of context and detailed explanations of the issues. True stories about where things go wrong in the world of banking. Available in hard copy only.

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that comes into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Thanks for your support and thanks to the numerous contributors.

Share on: