DLT offers the promise of faster, better & cheaper. There is real promise and even enough to have the ECB president, Mario Draghi, agree on the potential and acknowledge the ECB is looking at it.

Now nothing is going to happen by magic and certainly not by central bank diktat, so how might all this new stuff actually work and deliver on the promise? Might some history lessons help us identify what will and won’t work?

Any form of feedback on this week’s post will be very welcome; there is no map for navigating this new territory, so my hope is that the thoughts I offer help suggest a plausible path and help us avoid stepping on landmines. Please comment and share widely.

In matters DLT, there are some certainties for the institutional side of financial services (FS) that I can think of. First, CBDM Central Bank Digital Money will be essential.

- There will be a few things that do not require money, such as KYC/AML. Lots of promising work going on there to create central repositories or services with digital IDs that can be shared.

- There will be other things where money plays a smaller role and a new process might be able to tolerate an interface to the fiat world and still bring worthwhile improvement. Trade Finance and Supply Chain Finance come to mind.

- Many FS processes looking to use DLT will need “money on the Blockchain” aka CBDM in order to fulfil their potential.

The second certainty is that there will not be just one universal Blockchain / DLT. As an Operations guy, I like it when there is just one way to do post-trade things. Sadly, this is unlikely to happen. There are several different DL “approaches”. First there are different “fabrics”: Hyperledger Fabric, R3’s Corda and the Enterprise Ethereum Alliance (EEA)21, on top of which applications can be developed. Additionally there are approaches where the application is tightly coupled with the fabric, e.g. Digital Asset & SETL. I have not fully mastered all the new terminology, but in simple terms, this means there will be different platforms, with multiple applications on the platform and the same type of application might be on more than one platform, but the platforms might not necessarily be connected.

The third certainty is that future success needs cooperation today from all parties. Sell-side, buy-side, Central Banks, existing FMIs. For a very thoughtful, thoroughly researched and argued paper on how the buy and sell side need to work together, see the recent paper from Ian Hunt & Chris Mills.

So, with those certainties, how might the FS industry make this is all work for the better?

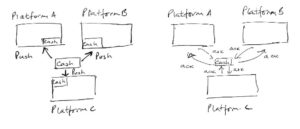

First, the money part, the CBDM. To my mind there seems to be two ways this might work. Well two once you are clear that for each currency there is one issuer. Option A – left – is that there is a central issuance of cash, which is then pushed into whichever platform needs it and then used internally in whatever applications sit on that platform. I call that the independent silo. In Option B – right – there is a mechanism to reach out to a central pool of cash where the cash side is moved centrally. I’ll call this the the single cash pool.

Option A might be very successful if one platform had a total or near monopoly of the business applications and the volume that went with this. One way to think about this would be if all, or nearly all, the Eurobonds and Equities and TriParty processing and OTC Derivatives in the world and the settlement volume were in Euroclear.

As so often, history can help guide us. It is unlikely that one of those products gravitates to just one place; Eurobonds have long been settled in both Euroclear and Clearstream aka Cedel for the older folk amongst us.

So, we need to accept that applications will be in different places and some identical or nearly identical applications, such as bond settlement, might be in more than one place. If Option A is adopted, then FS institutions will be faced with a modern version of a challenge they have today: too many bank accounts. Banks are not good at this at all.

The alternative is Option B, a central pool of cash which can be drawn on by any application on any platform. This is in fact the approach that the Swiss took when their CSD was re-designed at the end of ‘80s. This approach has now been in practice for over 25 years. The initial design called for an Option A like approach. That thinking was overturned* in favour of an approach like Option B.

The argument was made that having cash in many places made life harder than needed. A simple explanation swayed the argument. Imagine that all the money movements for a day are arranged like dominoes (cf. left hand side). A small push and all the dominoes will fall over. If however, you adopt Option A, some of those cash flows, the red ones, move away to another platform (cf. right hand side), those dominoes are not going to fall over so easily. A lot more active cash management would be needed.

The second certainty is that similar applications will exist on different platforms. Years back, Goldman Sachs was very active in the Swiss Franc Warrant business. Those warrants were eligible in multiple systems; the domestic CSD, as well as the two ICSDs, Euroclear and Clearstream. Our preferred settlement approach was to settle domestically in the Swiss CSD or from there via a so called electronic bridge with counterparts using Euroclear or Clearstream.

Sometimes we had counterparts who would insist on both sides settling in Euroclear; they would tell us that the Goldman trader had said this was ok. If we had agreed to this, an Option A type model, then we would have had the effort and expense of moving the warrants between the platforms. The expense is what is known as the “cost to carry”; if you first buy the warrants and hand over cash, then you have the interest expense until you can move the warrants and deliver them. So we refused and pointed out that it was not the traders’ prerogative to set the settlement conditions.

The option to use the electronic bridge is something known as “interoperability”. This has long been key in matters between the ICSDs, as well as between the ICSDs and the domestic CSDs. It has taken years of fine tuning to get this right.

Individual banks and FS market participants are generally involved in several of the consortia and ventures looking to build the new DLT infrastructure; some of this is driven by the so called “spray & pray” mindset, by which players are very uncertain of the outcome and simply place a wide number of bets. Sometime, FOMO, fear of missing out, drives actions. Often, the bets are made from a venture capital perspective, with an aim of cashing out later.

There are a couple of challenges that this environment presents. Firstly, as a rule in large organisations and banks in particular, any one left hand does not know what the many other left hands of the organisation are doing. This may hinder a thoughtful approach on the important points of interoperability and the approach to cash. Secondly, infrastructure is seldom a topic sponsored at the Executive Board level. This makes it that much harder to shape new industry wide infrastructure efforts.

*I am indebted to the independent mind of Itzi Klein for sharing his insights on matters cash and history of the Swiss FMI infrastructure.

Lessons to be Learned

Some thought and care is needed in the design of the new platforms and how they are set up to interact with each other. History offers us some vital pointers:

Interoperability: as we work to build on the promise of the new DLT technology, we need to consider how we design with interoperability as an option. Like with your new car; a factory fitted option is a whole cheaper and less awkward than retro-fitting later.

Central pool of cash: cash management is hard. The more separate buckets there are, the harder the task. Banks have not proved good at this with the current platforms. Simply transposing the same multitude of buckets to a new platform does not offer the promise of great strides of improvement. This does mean all solutions need to be built on the single cash pool basis, rather it means that participants and sponsors need to be very thoughtful about design. If their platform wants to use Option A, the independent silo, I would humbly suggest that needs to done after some very thoughtful deliberation.

Value of infrastructure: in FS, great infrastructure is an enabler of business benefit. SWIFT and CLS are two good examples of enormously valuable infrastructures that are not profit-maximising and are highly unlikely to have some IPO event that rewards participants with windfall profits. Their value is in their use.

Great care is needed with the direction that is given with the efforts to make the most of what DLT can offer. Coordination inside institutions and across them will be essential. A narrow VC type view with the aim of measuring return from sale or dividends of a stand alone investment is IMHO not going to build something that is any combination of better, faster or cheaper. Executive Board level awareness, involvement and sponsorship will be essential.

About the Author: The Bankers’ Plumber. I help banks and FinTechs master their processing; optimising control, capacity and cost.

If it exists and is not working, I analyse it, design optimised processes and guide the work to get to optimal. If there is a new product or business, I work to identify the target operating model and design the business architecture to deliver those optimal processes and the customer experience.

I am an expert-generalist in FS matters. I understand the full front-to-back and end-to-end impact of what we do in banks. That allows me to build the best processes for my clients; ones that deliver on the three key dimensions of Operations: control, capacity and cost.

Previous Posts

Are available on the 3C Advisory website, click here.

Publications

The Bankers’ Plumber’s Handbook

Control in banks. How to do operations properly.

For some in the FS world, it is too late. For most, understanding how to make things work properly is a good investment of their time.

My book tries to make it easy for you and includes a collection of real life, true stories from 30 years of adventures in banking around the world. True tales of Goldman Sachs and collecting money from the mob, losing $2m of the partners’ money and still keeping my job and keeping an eye on traders with evil intentions.

So you might like the tool kit, you might like the stories or you might only like the glossary, which one of my friends kindly said was worth the price of the book on its own. Or, you might like all of it.

Go ahead, get your copy!

Hard Copy via Create Space: Click here

Kindle version and hard copy via Amazon: Click here

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that came into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Share on: