Liquidity & Capital; two well known quantities which banks need to manage. That they have some cost is not news and not worth sharing. What I hope is worth sharing is a view of just how expensive those things are and what banks need to do to manage that expense.

This week’s post pulls together a view of the major regulatory driven costs associated with those staples of day-to-day banking: settlements and payments. I’d welcome your feedback on my views; are they right or wrong, do banks really understand them.

Banking in 2017 is in a very different place from when I started in this business in 1987 and even in comparison to the pre-Lehman years of this century.

| Then | Now |

| Lighter regulation | Regulation is more extensive and more precise:

BCBS 248 on Intraday Liquidity, BCBS 229 on Gross Settlement, LCR |

| Higher profits | Lower profits |

| Settlement / Operations / Back-Office seen but not heard | Settlement / Operations / Back-Office needs to be heard |

| Process weaknesses not so relevant | Process weaknesses now a major driver in the difference between profit & loss |

To illustrate the costs, I will focus on FX and payments related cash flows. Several key metrics are affected by whether those movements are net or gross.

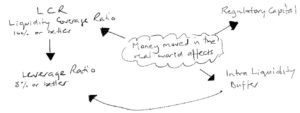

Money in vs. money out is a central aspect of LCR, the Liquidity Coverage Ratio. Even if after all money movements are done and you are flat, LCR dictates that you need so

![]()

me HQLA, High Quality Liquid Assets. This is because LCR caps at 75% the value of any incoming flows offsetting the outgoing ones. And you have to those for a month.

As soon as you have HQLA on the balance sheet, you also have to worry about the Leverage Ratio. It does not stop there; you also have to have Regulatory Capital. And, you have to worry about your Intraday Liquidity Buffer. Let’s look at some of those metrics in more detail.

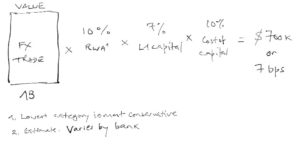

Regulatory Capital is a function of 4 things: the value of the payment or trade, the RWA (Risk Weighted Assets) factor, the level 1 capital charge and the cost of capital.  Of course these will vary by institution; the point is that there is an expense associated with the receipt of funds, because this is an asset.

Of course these will vary by institution; the point is that there is an expense associated with the receipt of funds, because this is an asset.

LCR is a newer metric. It’s aim is to ensure there is enough liquidity on hand to deal with the expected net outflows over a month. The cap on what percentage of inflows can be netted against outflows effectively means that 25% of the gross amount needs to be held in HQLA and

that for a month. The figure on the right shows the implied cost based on liquidity cost of 100 bps. Now inany bank, there might be other cash flows which might act as an offset and reduce the amount of HQLA needed. The point though is that there are some serious costs associated with settlement of FX and payments.

that for a month. The figure on the right shows the implied cost based on liquidity cost of 100 bps. Now inany bank, there might be other cash flows which might act as an offset and reduce the amount of HQLA needed. The point though is that there are some serious costs associated with settlement of FX and payments.

The Intraday Liquidity Buffer is another potential source of costs. As a rule of thumb, this is expected to be 10% of gross payment value in the real world. So the more you move, the bigger the buffer. This potentially adds another 10 bps in cost (10% x. 1% cost of of liquidity)

What does all of this mean for FX market participants and payments businesses?

There is a big difference between gross and net cash movement. At the moment, there are limited ways to net: bi-lateral netting or CLS, at least for FX trades. Both are well used. CLS is very effective in reducing funding needs; whilst trades are settled gross, only the net balance in  each currency needs to be funded. Overall CLS reduces the amount of cash moved by 96%; for the smaller participants, this may be only 90%. This makes a really huge difference.

each currency needs to be funded. Overall CLS reduces the amount of cash moved by 96%; for the smaller participants, this may be only 90%. This makes a really huge difference.

CLS has new services either being rolled out or in development both of which will help increase netting. First, the FX forwards compression JV with Triana, TriReduce. Some recent client work suggests that even for a smaller FX player, the regulatory capital savings would be worth having. It is available now, but only to Settlement Members. CLS Now is a future service for same day settlement. CLS Netting is an additional service, intended for FX trades that cannot settle through the main CLS process because one or both currencies are not eligible.

There are other new services being developed. NEX recently announced a netting service. This is aimed at the buy-side. There is also an offering being developed called Cash Netting Services.

Lessons to be Learned:

Net vs. gross money movements is a crucial part of the operational process which needs to be monitored and finely tuned.

CLS is a great facility. It is showing ambition with new products, all of which could help reduce cash flowing in the real world. To date though, CLS is a one-trick pony; it’s track record of moving beyond its original core product is not impressive.

The on-going efforts to add new netting capabilities might each add some benefit. But, and it is a big one, they are all dealing with bi-lateral netting. Looking at the costs and the impact of CLS that eliminates 90% of the costs associated with gross settlement, I think we need something more than bi-lateral and also, we know from the pre-CLS experience of FXNet that the operational processes associated with processing bi-lateral netting are challenging. Way back when, the ability of CLS to offer net funding and gross settlement was decisive.

Another means to manage liquidity costs is better control of intraday liquidity, which is required by BCBS 248. That requires better reporting and also more central control over payment timing. I have written about this in prior posts.

Of course, reaping the benefit of the netting in overall group level data requires the right level of granularity in data flows and the correct differentiation in the group reporting logic. Given the state of risk reporting and data quality assurance in banks, to use the words of Sir Humphrey Appleby, assuming that the data is correct and properly processed would be a “courageous decision”.

Cost allocation. A dreaded topic. That needs to be done correctly to encourage the right behaviour. I have my doubts as to how well costs are understood and allocated in the banks.

About the Author: I help banks master their post trade processing; optimising, re-engineering, building.

I understand the front-to-back and end-to-end impact of what banks do. That allows me to build the best processes for my clients; ones that deliver on the three key dimensions of Operations: control, capacity and cost.

Previous Posts

Are available on the 3C Advisory website, click here.

Publications

The Bankers’ Plumber’s Handbook

Control in banks. How to do operations properly.

For some in the FS world, it is too late. For most, understanding how to make things work properly is a good investment of their time.

My book tries to make it easy for you and includes a collection of real life, true stories from nearly 30 years of adventures in banking around the world. True tales of Goldman Sachs and collecting money from the mob, losing $2m of the partners’ money and still keeping my job and keeping an eye on traders with evil intentions.

So you might like the tool kit, you might like the stories or you might only like the glossary, which one of my friends kindly said was worth the price of the book on its own. Or, you might like all of it.

Go ahead, get your copy!

Hard Copy via Create Space: Click here

Kindle version and hard copy via Amazon: Click here

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that came into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Share on: