With all the talk about Blockchain aka DLT, I have heard several statements on how new processes will not and should not replace current RTGS systems because the ones we have function pretty well and we don’t need to change them.

Au contraire, I would say. We very much need some change, though not for every form of payment. My belief is that the RTGS (Real Time Gross Settlement) model is broken for wholesale business, for the institutional flows associated with settlement in financial services.

Please take 10 minutes to read this post and comment, share and give a “like” if I have got this something like right. I need that market colour, as I am working with a USC Consortium on next generation solutions.

RTGS systems have been around a while. The Swiss SIC system was the first in the late 1980’s. These systems are highly evolved, super efficient and have some solid rules & governance to make sure banks play fairly, for example with rules on volume and value throughput to ensure no bank can be a free rider, simply waiting to be paid and using others’ liquidity.

Some RTGS systems have added some sophistication, with so called Liquidity Savings Mechanisms (LSMs) to help speed up settlement. Looked at in isolation, RTGS are both efficient and effective. Huge volumes of payments, settlement happening without a hitch, day in, day out.

So, what is the case for making some changes?

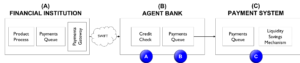

Liquidity and Intra-day credit risk. Two topics that are inter-connected. To make the wheels of settlement go around each day, payments need to move from left to right in the lifecycle diagram below.

Liquidity buffers are high because the default means of settlement in wholesale is gross payment; regulators want to see banks holding enough liquidity capacity to ensure they can settle everything.

Gross payments, and the RTGS rules on throughput volumes and values to avoid “free-rider” activity together force Transaction Banks to give intra-day overdrafts to clients (Point A). This is done knowing that clients will almost always be “flat” or very close to it at the end of each business day.

For institutional clients, the intra limit can be a very big number, as in hundreds of millions. The queuing mechanisms inside the banks (Point B) are tuned to meet the rules of the RTGS systems, releasing payments to ensure the prescribed schedules are met.

The intra-day overdrafts have undesirable consequences:

- For the credit giver and credit taker, this flows into intraday liquidity reporting and principles (BCSB 248)

- For the credit giver aka Transaction Bank aka Correspondent Bank, historically intra-day credit has been something that is not explicitly charged for. There are some cases, such as CLS or Margin Payments to CCPs, where there are explicit fees, however increasingly the fact that for the broad mass of payments there is a per ticket charge and not a value charge is increasingly painful in terms of impact on P&L. Pain caused by charges from Treasury for liquidity buffers.

- For the regulators, this creates dependencies and risk amongst the banks.

Existing Liquidity Savings Mechanisms (LSMs) are not really helpful in regard to intra-day because they are downstream of the credit process. (See Point C vs Point B below).

In today’s payments set-up, every day a clearing bank will make hundreds, even thousands of payments to another local bank and see a similar number and value come back the other way. There is a lot of busy work even though the flows net out to a very large extent.

Lessons to be Learned

Of course, this situation did not happen overnight. Historically, banks have been pretty sanguine about intra-day lines, for the largest part not understanding the cost of what what they were giving away as part of the overall service.

Today, liquidity costs are in focus and those costs are finding their way down from being a corporate expense to being an expense charged to business lines. At the same time, regulators are laser focussed on liquidity.

There is no easy way out; banks could reduce intra-day lines for clients, if their payments system have the capacity to do all the “air traffic control” that goes with such a step. But, there are limits, as they still have to meet the RTGS KPIs.

What we have in 2018 is a very expensive apparatus to support the status quo. Banks could, of course, start charging for intraday liquidity. That would simply be a tax, because it is difficult to avoid using intraday overdrafts. Difficult, not impossible; a single FI might instruct its agent bank never to use an intra-day overdraft. This would result in a lot of queuing of payments. AN FI might try to borrow money rather than use an overdraft; but, those funds would be subject to the same law of physics, waiting to be executed in the RTGS system. Agent banks would no doubt optimise around the changes.

Better yet would be a new mousetrap. A new settlement model that did not rely on intraday credit limits.

About the Author: The Bankers’ Plumber. I help banks and FinTechs master their processing; optimising control, capacity and cost.

If it exists and is not working, I analyse it, design optimised processes and guide the work to get to optimal. If there is a new product or business, I work to identify the target operating model and design the business architecture to deliver those optimal processes and the customer experience.

I am an expert-generalist in FS matters. I understand the full front-to-back and end-to-end impact of what we do in banks. That allows me to build the best processes for my clients; ones that deliver on the three key dimensions of Operations: control, capacity and cost.

Previous Posts

Are available on the 3C Advisory website, click here.

Publications

The Bankers’ Plumber’s Handbook

Control in banks. How to do operations properly.

For some in the FS world, it is too late. For most, understanding how to make things work properly is a good investment of their time.

My book tries to make it easy for you and includes a collection of real life, true stories from 30 years of adventures in banking around the world. True tales of Goldman Sachs and collecting money from the mob, losing $2m of the partners’ money and still keeping my job and keeping an eye on traders with evil intentions.

So you might like the tool kit, you might like the stories or you might only like the glossary, which one of my friends kindly said was worth the price of the book on its own. Or, you might like all of it.

Go ahead, get your copy!

Hard Copy via Create Space: Click here

Kindle version and hard copy via Amazon: Click here

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that came into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Share on: