Reference data is either the root of all evil or the fountain of all good. My experience is that this is an 80:20 in the devil’s favour.

Standing Settlement Instructions, SSI’s, are the subject of this week’s thoughts with inspiration coming from actual market experience where things really did not go according to plan.

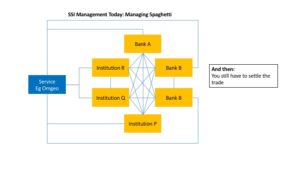

With our FMI’s, Financial Market infrastructure, as they stand, every market participant is required you source, file and administer every SSI from every party they want to business. In times past, we used to use the term Static Data; that is no longer up to date. As my learned and experienced friend Steve Lachaga has pointed out: ïf only it would stay static”.

SSI’s change and even if it is not frequently, my recent observations suggest we do not learn much and unless something changes are set to endure the pain factor we all retire.

A few weeks back, a very large FX market participant changed their provider for CLS Third Party Services. They did all the right planning: sending out advanced information, making SWIFT broadcasts. None of it helped; they had to cancel and correct some 50% of their trades, settling them outside CLS. Part of the problem was an unwise choice of switchover date; doing these things on a Monday. The other part was just poor execution by their counterparts.

More recently, a bank switched from being a Third Party in CLS to being a Settlement Member. Again, meticulous and exhaustive preparation; several communications by email and even phone calls, all well in advance of the event. A couple of counterparts changed too early and the rest all failed to make the change. Many it seems were hampered by only being able to make changes on weekends; one of these banks made such a meal of things they got it wrong three weekend in a row. I talked with the COO at one of the counterparts that messed up; he recounted how his reference data team had the notices in good time, but made up various excuses for having to come and ask for an emergency change. The COO agreed with my observation that the excuses were right up there with “the dog ate my homework” in terms of how lame they were.

This is an FX example, but the pattern is a familiar one. some banks can only make changes at the weekend. Many banks it seems are not capable of reading and then executing a plan. In the eternal battle between good and evil on things reference data, the devil won this one hands down.

“Immutable data”, in other words data that is quite categorically and undeniably accurate. That is actually something that the Blockchain would be good for; its credentials for ensuring data is authenticated and only accessed by the right parties are clear.

Lessons Learned: None of the work that the banks making the changes to their SSI’s or their counterparts have to make to keep up adds even one cent of added value to anybody. It is all busy work that is just about having to play the hand they are dealt.

Looking at the two real life examples, having a source of “immutable data” would not have prevented the problems these banks faced; the current process where each institution stores SSI’s and then instructs externally meant that the emphasis is on internal execution. Blockchain alone is not the answer.

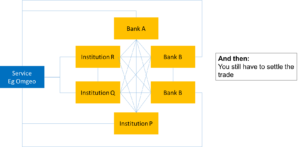

To make a real difference and truly realise efficiencies, our industry needs to change the way we settle transactions. Imagine that these banks had stored their SSI’s in a central library called the SSI vault, with appropriate effective dates. Just one place for all settlement needs, globally. CLS Bank would be an authorised subscriber. Now all the two parties to the trade would need to do would be to know that the trade is settling in CLS and then instruct CLS: I Bank A, with LEI, Legal Entity Identifier “A1” have done a trade with Institution P, with LEI “P”.

The SSI’s are of no consequence for matching; the two parties can simply agree they have done a trade at CLS and CLS Bank can source the SSI’s just in time.

Far less data to manage, less overhead in Operations and some benefit from the Blockchain; a holy trinity. And, there is no need to replicate the data in the Central SSI Service to every user, rather a subset of the Blockchain technology could be used simply to create the “central store of immutable data”. l

Next week some thoughts on how to apply the same principles in other FMI’s.

Understanding Bitcoin and Blockchain

My own epiphany in matters Bitcoin and distributed ledger technology is the result of three independent sources: I am indebted to Emmanuel Mogenet at Google for his inspiring gift of a Bitcoin, to Richard Brown at R3 CEV for so readily sharing views and educating the latecomer and finally to Silicon Valley legend and LinkedIn CEO, Reid Hoffman for his seminal article in the May 2015 edition of Wired UK: “Reid Hoffman: Why the Blockchain matters.”

I also highly recommend reading an Oct 31st 2015 article in the Economist: “The great chain of being sure about things”. A key thought is around “certainty”; how the Blockchain can improve record keeping.

Previous Posts

Are available on the 3C Advisory website, click here.

Publications

The Bankers’ Plumber’s Handbook

How to do Operations in an Investment Bank, or not! Includes many of the Blog Posts, with the benefit of context and detailed explanations of the issues. True stories about where things go wrong in the world of banking. Available in hard copy only.

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that comes into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Thanks for your support and thanks to the numerous contributors.

Share on: