Back from the summer holiday and time to take up the Bitcoin challenge once more. In the last post, I put forward the idea that Bitcoin has some advantages over gold. This week I hope I want to look at where Bitcoin falls down as a means of payment. This is something I consider a necessary step on the way to understanding how to use a “digital currency” or a “digital asset”, rather than Bitcoin in particular.

Uncertain Value

Bitcoin is an anonymous system. Bitcoin exchanges act as intermediaries to allow traditional currencies, so called “fiat currencies”, to be exchanged for the digital currency. Nothing unusual about the idea of an exchange; during the holiday season many readers will swap Pounds for Euros at their bank or the Travelex booth at the airport.

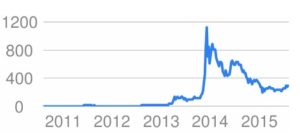

The “exchange rate” can be understood as the price in USD. This has varied greatly. Now if you can invoice in Bitcoin and pay bills in Bitcoin, you are a little less worried about this. Now let’s say you want to pay for the latest David Baldacci book in the Amazon Kindle store with Bitcoin. For Amazon this is a challenge, as their costs are in Pounds, Dollars and so on. So they might make you a price, but at a very conservative rate. As an aside, this is not to dissimilar to the problem faced by many Swiss companies in 2015; the bulk of their costs are in a very strong Swiss Franc and a sizeable share of their revenues is in weak Euros.

So, simply put, even if paying in Bitcoin is technically both achievable and simple, it is unrealistic to expect widespread adoption as a means of payment.

Bitocoin price in USD

Trust

Many bankers may be greedy and pay themselves ridiculous bonuses and some banks may have recurring IT problems, but exceptional circumstances aside, broadly you trust your bank, or credit union or building society.

If you have EUR 120 in your bank account, you expect to be able to go to the bank and collect your money. Now that works as long as you are not in Greece and as long as not everybody wants their money at the same time.

Already, the first cases of fraud in the Bitocoin world are surfacing. Only last week the CEO of Bitcoin exchange, MtGox, was arrested in the wake of a black hole of USD 387 million leading to the firm’s collapse. Of course there is an exceptional case to report; a smart person offered to pay out Bitcoin balances as Euro in Greece via an ATM in summer 2015.

Understandably, it will be very difficult to persuade the broad masses, that a digital balance in a purely digital currency will always be there. Of course in developed countries, there is even depositor insurance: in the US, SIPC guarantees the first USD 250’000 and in Switzerland the government covers the first CHF 100’000.

Lack of KYC / Know your customer

Bitcoin is a not subject to any of the KYC checks that a normal licensed bank will perform; I was given a Bitcoin at a dinner party by a host who simply set up an account on my iPhone. Now Bitcoin is not anonymous; if you think it is, see this on how the Silk Road platform, a hotbed for nefarious transactions, was investigated.

Nonetheless, even as somebody that loves easy processes, I would say it is a bit too easy to open a Bitcoin account.

Lessons to be Learned

So Bitcoin as a specific platform has some serious issues.

Realistically, I have had my Bitcoin for some six months or so and not once has anything happened where I have been asked to pay with it, nor has any situation arisen when I have any opportunity to do anything with this digital balance.

In the next post, I will look at how digital currency or a digital asset might be better than its real world equivalent.

Understanding Bitcoin

My own epiphany in matters Bitcoin and distributed ledger technology is the result of three independent sources: I am indebted to Emmanuel Mogenet at Google for his inspiring gift of a Bitcoin, to Richard Brown at IBM for so readily sharing views and educating the latecomer and finally to Reid Hoffman for his seminal article in the May 2015 edition of Wired UK: “Reid Hoffman: Why the block chain matters.”

Previous Posts

Are available on the 3C Advisory website, click here.

Publications

The Bankers’ Plumber’s Handbook

How to do Operations in an Investment Bank, or Not! Includes all the Blog Posts, with the benefit of context and detailed explanations of the issues. True stories about where things go wrong in the world of banking. Available in hard copy only.

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that comes into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Thanks for your support and thanks to the numerous contributors.

Share on: