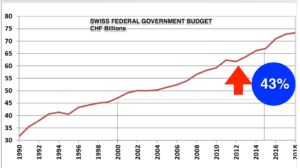

In 15 years, the Swiss Federal Government’s budget has ballooned from CHF 47 billion to some 67 billion. Since 2000 times have been good and the government has grown like topsy. The same is true at banks; revenues are down and costs are out of whack. Similarities between government bureaucracy and banks. That is this week’s focus.

Savings & cut backs are a staple diet for banks today. Largely though, that is about simply doing the same things with fewer people with some vague hope that magically things will be more efficient. A hiring freeze is often coupled with that, be that in banks or in the government. That will only save a bit of money whilst in practice leaving were people to do just as much work as there was before, with unhappy staff a likely outcome.

To make real improvement requires a conscious decision to actually no longer do something. Clearly, if a bank exits a business completely, as for example RBS is doing with parts of its Investment Bank, then all supporting functions will cease too; a perfectly reasonable and good thing.

Where there is cost is in bloated administrative functions that have simply grown over time. Cutting out those costs means challenging why and how the task is performed. HR, Human Resources, offers some shocking case studies:

Staff in “Pools” or “at risk”; two friends called me recently. The first to tell me he was “in the pool” at one of the Swiss bank; in other words he had to find a job in a certain time frame or leave the bank. Another, who is involved in a local body-shopping outfit called me to ask if I was interested in a role; one that was clearly at the bank my friend “in the pool” was at and one he would be well suited for. Now it is just possible that somebody new about this, but really prefers to see my friend leave the bank. My suspicion, supported by personal experience, is that those in HR supporting this “pool” process have no idea at all what other needs there are. HR is clearly not managing talent.

Talent development; another friend a headhunter. From some work he did around private banking in Monaco, he realised there was a great opportunity for one of the Swiss banks to upgrade its presence in the principality. He approached the European regional head, who had him speak with his 20 strong talent development team. “We know the market, we know the players, we don’t need you”. They tried to send him away; when he did persist and prevail; in-house HR really did not have the know-how to hire C-Suite execs. HR were involved in finalising terms. A total mess ensued and the guy went elsewhere; insiders really do not know better than the market. A team of 20 will be a CHF 3 million fixed cost; love them or hate them, headhunters are a variable cost and only get paid if they get the right people.

Fringe Benefit Frills: my wife works for one of the big Swiss banks. Every year, HR sends her notice of an an employee perk called REKA. This is a holiday venture, supporting activities in Switzerland. For CHF 800, my wife can buy CHF 1’000 of REKA vouchers. A CHF 200 perk. UBS has some 25’000 employees in Switzerland, some subset of which will be entitled to this perk. Now fringe benefits offer some saving of social security taxes, but really, if you want to give my wife 200 francs more, just give it to her and save yourself all the administration around this perk.

Lessons to be Learned: Stopping the bloat means challenging why things are still done and how they are done. Does it still need to be done and is there a more cost effective way to get it done?

Previous Posts: Are available on the 3C Advisory website, click here.

Publications:

The Bankers’ Plumber’s Handbook

How to do Operations in an Investment Bank, or Not! Includes all the Blog Posts, with the benefit of context and detailed explanations of the issues. True stories about where things go wrong in the world of banking. Available in hard copy only.

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that comes into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Thanks for your support and thanks to the numerous contributors.

Share on: