Bi-lateral netting. Simple concept. Recent conversations with market practitioners and FinTech vendors have me wondering what the market needs. Below are some observations on the area and some questions; this week I would be grateful for active feedback. Give generously.

This is the sixteenth in a series of posts on how banks and FI’s might adapt to new BCBS guidelines on intraday liquidity and FX settlement risk. The previous posts are available on the 3C Advisory website, click here.

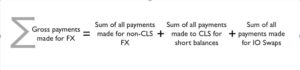

The BCBS guidance is that the credit risk must be included until the reconciliation. It seems that Treasuries are charging the associated liquidty costs to the FX business based on the sum of all the payments made outside CLS, plus the sum of all the short balances in CLS, plus out leg of the payments on the IO swaps for CLS.

If an FI is already using CLS, the ability for a particular FX department to influence these flows is actually severely limited. The second and third elements of the equation cannot be influenced by any one bank, and if the bank is of any size, participating in the IO swap process is essential in order to ensure that the CLS-driven needs are not too large.

If an FI is already using CLS, the ability for a particular FX department to influence these flows is actually severely limited. The second and third elements of the equation cannot be influenced by any one bank, and if the bank is of any size, participating in the IO swap process is essential in order to ensure that the CLS-driven needs are not too large.

At the level of the FX business in an individual FI, the only tools available to deal with liquidity charges based on gross payment are:

a.To use CLS if you do not use it already

b.To bilaterally net with the counterparts to those trades that are not in CLS

c.To refuse to deal with c/parts who want to settle CLS eligible trades outside CLS

From a processing perspective, netting is simple, but it involves a series of steps:

a.Agree to net with counterpart

b.Agree and sign netting documentation; trade date or value date netting

c.Flag the counterpart as netting in your “client master data”

d.Hold up the trades in your FX processing

e.Amend or suppress confirmations

f.Daily routine to call the client and agree net results

g.Process net results; normally with input and approve steps

Step b, documentation, is not at all straightforward. Corporates have a habit of wanting contracts under their local law, which is something the sell side does not like. Netting without documentation is not at all uncommon. From a daily business perspective, there are two generalisations one can make. First, it is normally the dealer who has to initiate the process. The dealer would prefer to use CLS if at all possible and is generally likely to be quite efficient. Nonetheless, the monkey is on the dealer’s back. The second generalisation you can make is the 5-5-5 rule. Dealing with a netting client involves five minutes of polite chit-chat, five minutes to agree on the numbers and five minutes, once you have put down the phone, to deal with the processes on your side of the systems, which may involve some input and will certainly involve an approval. Five minutes to agree on the numbers is a good day. If they do not agree, then you have Operations staffers at either end of the phone, trying to reconcile.

Case Study: Inequality of Arms

In days at Credit Suisse, we would net between the London branch and the Zurich head office. The London branch had all the sophistication of relatively new systems: easily able to calculate the net numbers and to process the results. In Zurich, they had the mainframe. If the numbers agreed, then happy days. If they did not, and they often did not, it was like looking for a needle in a haystack. A haystack of several hundred inter-company FX trades.

Another inequality, which is pretty typical, is the one of product. Netting in FX might work; netting across FX and derivatives is very often a complication too far, largely as a result of disparate systems. It might seem easy to the outsider, but FIs are very much challenged as soon as they have to fiddle with the original transaction that was booked. To do that and then to deal with accounting entries across multiple product platforms is very likely to be a bridge too far.

This bilateral netting process is not really scalable. You need to be very organised, and you need to call each of those counterparts during their day. Working overtime will likely not help if the people you need to talk to have gone home.

Bilateral netting is really something that is good in theory and actually somewhere between awkward and difficult in practice.

Questions & Debate:

- Activity: Is there explicit pressure on FX Operations to ensure that anything non-CLS is netted?

- Ease: Is the 5-5-5 picture of the effort required today a reasonable one?

- Tools: This one in parts:

- Are the current tools adequate to do this?

- Does it make any sense at all to try to adapt CLS processing so that the likes of Fundtech / Logica / CGI, have this as function in their systems? If the answer tis yes, should the Settlement Members only process their own trades or offer to include this as a service extension for their Third Party service offering?

- Is there a need to go further and create a new platform, one that helped organise the non-CLS netting?

A personal request: Finally. I have ventured into self-publishing. The not so creatively titled, but practical guide: “Cash & Liquidity Management: Mastering the Challenges of New Regulations and a Changing Marketplace” is now available in print and on Kindle. All the bits form the Blog are there, together with a lot of detail on current challenges. Many of those challenges will take effect on Jan 1 2015. Time to be well informed! As too is the book on more general operations issues.

Book #1: The Bankers’ Plumber’s Handbook

How to do Operations in an Investment Bank, or Not! Includes all the Blog Posts, with the benefit of context and detailed explanations of the issues. True stories about where things go wrong in the world of banking. Available in hard copy only.

Book #2: Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that comes into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Thanks for your support and thanks to the numerous contributors.

Share on: