“It’s all ‘bout the Ba(lance)S(he)e(t), ’bout the Ba(lance)S(he)e(t)”. The Balance Sheet. A great friend and old colleague, Nick Nicholls, helped make this very clear in his appeal to focus on the Balance Sheet in his most recent post. With all the changes in regulations and regulatory focus, I would add an extra dimension to this; everybody involved in banking has to think about the Balance Sheet as if it were something that were constantly being calculated in real-time.

Since time immemorial, in the FS business we have thought of the B/S as something we do periodically: month end, quarter end and year end. Intraday has with a few scant exceptions not been a unit of measurement. All of us simply threw a lot of payments to our Nostros and into the payment systems and cared only that payments were made on value date; any time on Monday will do nicely thank you.

Once clearing came along, there was a need to make payments before a specific time. The advent of FX settlement via CLS Bank in 2002 added to this. Clearly Nostros had less discretion and had to make sure that liquidity was on hand. In many cases, the result was that Nostros chose to charge for the value of what was being paid, rather than simply charging the traditional ticket fee.

With the guidance in BCBS 248, the demands on banks to master intraday liquidity management require those banks to think about their business as if the B/S were being calculated in real time.

In 2016, under a new, more precise regulatory regime, both the banks and their Nostros have to look at a near real time view of the B/S. There are two aspect to this: Credit Taken and Credit Given.

Credit Taken

Those who buy a service from a Nostro need to understand when they are using an intraday overdraft limit, or IDL. In a real-time view of the B/S this is a liability. Without that support from the Nostros the bank would not be able to meet its obligations.

The regulators are really looking at this like an insurance company looks at house insurance; the bigger the house, the bigger the risk and the bigger the premium. In this case, that premium is the size of the intraday liquidity buffer.

Traditionally in Financial Services, cost savings come from cutting heads. That standard recipe will not work here. Salvation will require each institution to look at its gross payments. Does the payment have to be made gross? Can it be netted? Can it be settled in some other way?

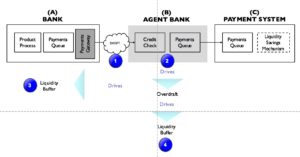

Agent Banks will, as a rule, report the debit as soon as the internal credit check in is complete. It is at that moment that there might be an overdraft and as soon as there is one, this will influence the Liquidity Buffer.

If there are fewer payments (1) going from the Bank (A) to its Agent Bank (B), then this reduces the potential impact on the Overdraft (2). Lower Overdrafts reduce the potential impact on two different Liquidity Buffers. First, the Bank may be able to reduce its Liquidity Buffer and the Agent Bank may able to reduce its own Liquidity Buffer.

Each market participant has to deal with the market infrastructure on hand, so there are limits to efficiency and effectiveness. That said, there will be a lot of scope for measures a single bank can take on its own. Real client work for an IB revealed the potential to reduce cash movements in the real world by 50%.

Credit Given

Those banks who offer Nostro services are obliged by the new regulations to measure the credit that they give to their clients. Every Nostro will already be checking each payment request against the overdraft facility in real-time. Inside the Agent Bank, the size of those overdrafts will be a factor in driving internal cost allocations for the Agent’s own Liquidity Buffer. The Agent Bank also has some other constraints; rules for the local payment system will normally require that a a certain percentage of value and volume be completed in the real world by a certain time in the payments day.

To meet the rules in the payment systems, Agent Banks need to receive the payments in plenty of time and process them through their own systems out into the payment system. This means that Agent Banks need to give their clients overdrafts. As soon as they do that there is double jeopardy; the Agent Bank might pass those costs on and for the Bank, that overdraft will drive their own Liquidity Buffer.

Lessons Learned: For all the advances and clever new products, banking is also ‘bout the basics, ‘bout the basics.”

The key to not having a big buffer is not to have big intraday overdrafts. That requires optimisation of payments. Banks need to imagine their Balance Sheet were calculated in real-time, on the fly.

Previous Posts

Are available on the 3C Advisory website, click here.

Publications

The Bankers’ Plumber’s Handbook

How to do Operations in an Investment Bank, or not! Includes many of the Blog Posts, with the benefit of context and detailed explanations of the issues. True stories about where things go wrong in the world of banking. Available in hard copy only.

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that comes into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Thanks for your support and thanks to the numerous contributors.

Share on: