Please Sir, I want less

Today, your Nostro allows you an intraday overdraft limit. It is unadvised and uncommitted; the Nostro can and might take it away without notice.

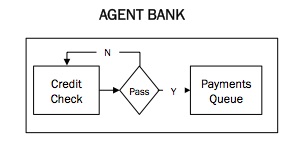

As a rule, Nostros process your payments on a FIFO basis. Most banks release payments to the Nostro sometime on value date – 1. As those payments arrive at your Nostro, your limit is checked. If there is room between any balance and the limit you have been given, the payment is approved and a provisional booking made to your account. When the payment is actually made is entirely another matter.

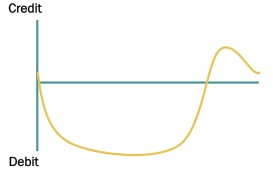

If you could measure your intra-day balance, it might well look like the diagram at left. Simply because you are given an intraday overdraft, your payments will be approved. With a few measurements you would actually be able to work out what this unadvised limit is.

If you could measure your intra-day balance, it might well look like the diagram at left. Simply because you are given an intraday overdraft, your payments will be approved. With a few measurements you would actually be able to work out what this unadvised limit is.

Now, if you are uncomfortable with the number and do not want to run the risk of this being considered too large, you could ask the bank to commit to not creating an OD that is perhaps ½ of that.

That limits your use of their credit, which is certainly a cost driver. But, it will force the agent bank to work harder to queue your payments. Are the bank’s systems up to it?

The agent bank’s system will now have to manage a bigger queue. This is the same as Air Traffic Control at Heathrow; capacity is fixed, ignoring the impact of fog, or god forbid snow, demand varies. The challenge for a payments system is a function of both payment volume and limits. We should not take it for granted that the systems are up to the task at every bank. More A&E at an NHS Hospital than Jack Bauer in 24.

Lessons to be Learned: This is a simple tool to counteract the potential unwanted consequences of being seen to use too much credit. An added plus here is that as a client, you are not sending the payment any later, you are just imposing the heavy lifting, or queue management, on the Nostro.

There is a potential banana skin; if the first payments out the back door of your systems are always large, there is a possibility that your new, smaller limit leads to just a few large payments being made, which may not make the payments wheels go around quite so efficiently as when many small payments are made.

The Nostro too has a challenge; it will be on the hook to ensure it meets the throughput targets of the local payments systems.

I am extremely grateful to the redoubtable Fritz “Itzi” Klein for the precious insight on “I want less”.

Previous Posts: Are available on the 3C Advisory website, click here.

Publications:

The Bankers’ Plumber’s Handbook

How to do Operations in an Investment Bank, or Not! Includes all the Blog Posts, with the benefit of context and detailed explanations of the issues. True stories about where things go wrong in the world of banking. Available in hard copy only.

Cash & Liquidity Management

An up to date view of the latest issues and how BCBS guidance that comes into force from Jan 1 2015 will affect this area of banking. Kindle and hard copy.

Hard Copy via Create Space: Click here

Amazon UK: Click here

Amazon US: Click Here

Thanks for your support and thanks to the numerous contributors.

Share on: